If you formed an LLC, one of the first things you’ll need is an Employer Identification Number (EIN). Even if you don’t have employees, an EIN is often required for opening a bank account, getting credit, or filing taxes.

Good news: you can get an EIN for free, in minutes, directly from the IRS website. Here’s how!

The easiest way for most businesses to file for an EIN is online.

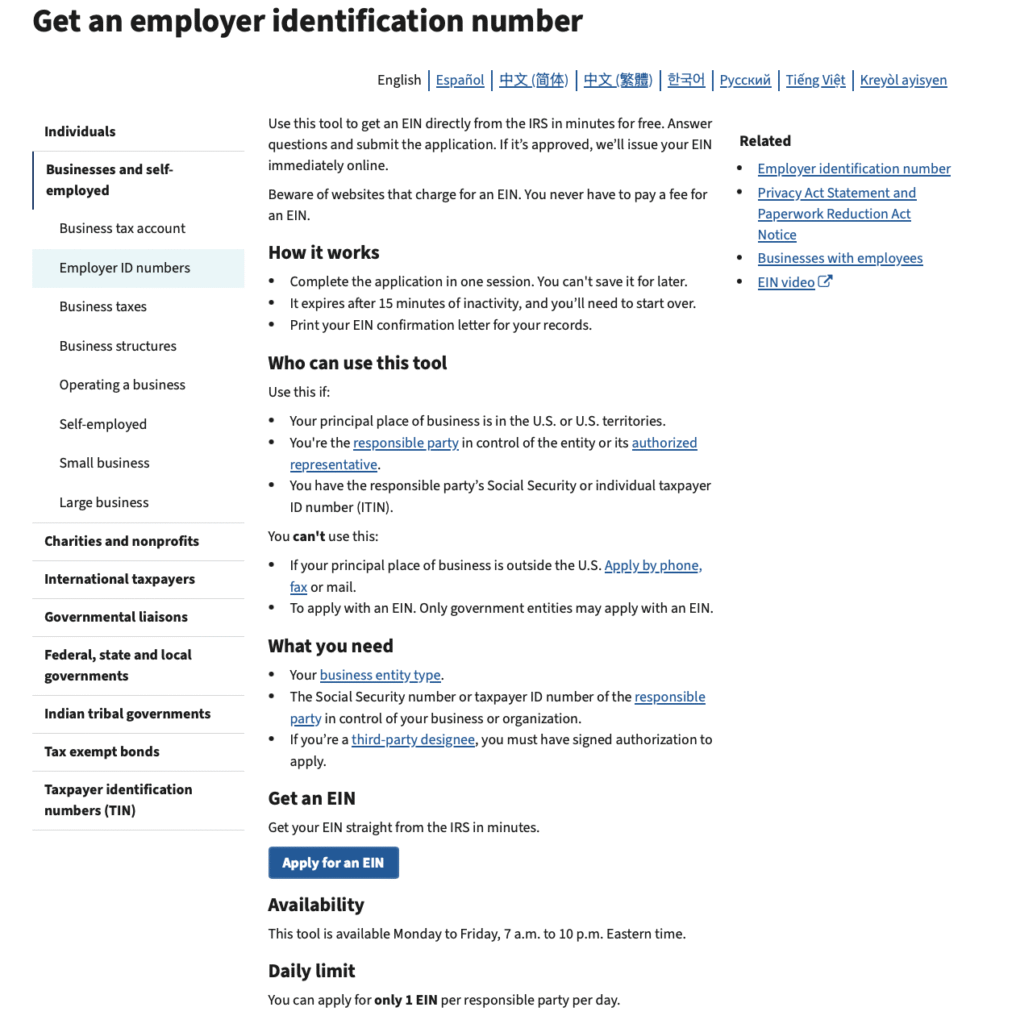

- Go to the EIN application section of the official IRS website.

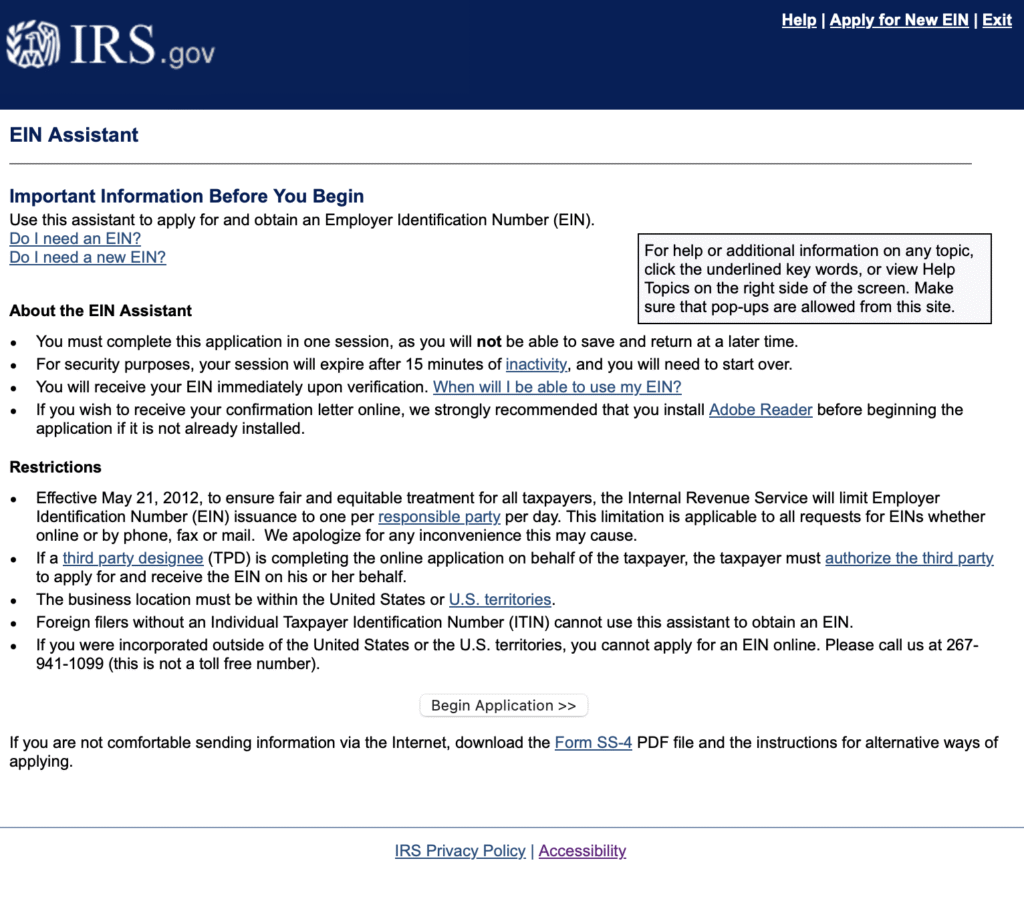

- Click on the “Apply online now” button. Review the guidelines on the information page, then click “Begin Application.”

- Select your business’s legal structure (e.g., sole proprietorship, LLC). The IRS provides brief descriptions for each type. Press continue.

- Here, the steps diverge depending on your business type. If you’re applying as an LLC, for example, you’ll need to enter the number of members and where the business is physically located, while a sole proprietor will need to provide more information such as a reason for applying. State whether you are the business owner or acting as a third-party designee.

- Input the legal name, trade name (if applicable), and physical address of your business. Specify the county and state where your business operates. This is important for tax purposes.

- Tell the IRS why you’re applying for the EIN. For instance, are you starting a new business? Hiring employees? Restructuring an existing company?

- Describe your business’s primary activities. The IRS will provide a list of categories you can select from.

- Double-check all the information you’ve entered for accuracy, then submit the application. You’ll receive your EIN right away and can download or print the confirmation for your records.

Apply for an EIN

Begin Application